Doing your finances by using a smart spreadsheet

Most people nowadays seem to agree that doing your finances is a useful thing.

I’ve being doing it consistently over the last 7 years. There are 2 things that helped me to do that:

- Having a discipline around it

- Having a flexible and consistent tool

Purpose of Doing your Finances

Before you even start doing your finances, it’s good to ask yourself why you want to do it. Few reasons could be:

- Save money towards a goal

- Track money

- Optimize your spendings

When I started tracking my money, I was doing this to understand how much money I actually have. I had only 2 bank accounts, and I was doing some freelance job. But because freelance payout wasn’t constant, and often delayed, keeping track of that allowed me to better understand how I’m doing.

Today I have over 10 different buckets where money can be (bank accounts, investments, pension, electronic money, debts towards me, pocket money…). It definitely helps me understand how much money I have, and where they reside. Also it helps to understand how much I spend overall.

Discipline

In order to make it work, checking your finances has to be done at constants intervals. Because most people get salary and pay rent and bills every month - I recommend doing it monthly. It may be tempting to do it every 2 or 4 weeks, but looking back - it wouldn’t work for me that well.

So every 1st day of every month I’m trying to update the doc. If I do it on 2nd or 3rd day of the month, then I try to write down values that reflected my accounts for 1st day of the month.

Advanced Features

It seem that’s easy to track how much money you have. In my specific case there were few complications.

Multiple currencies

I had money in few different currencies. Main ones were USD, RUB and MDL. Later I had some EUR (mostly for traveling). After that GBP came into equation.

So the spreadsheet should account for different currencies.

Currencies fluctuations

The issue with multiple currencies is that every 1-2 years, at least one of the currencies fluctuated a lot. Because in the end you want to know how much money you have in total, that would mean that that number will get skewed a lot.

For example if say you have 1000 Euro and $1000. And say that at the beginning of month the exchange rate is 1.5. That would mean that you have overall $2500.

If next month’s exchange rate would drop to 1.4, then you’ll have $2400, without you doing anything. So it would look like you spent $100 more than you actually did.

And if the exchange rate would go up again, then that month would look like you spent $100 less.

Investment fluctuations

If you invest (say Index Funds, or Bitcoin) then the same will happen as with currencies fluctuations.

The Template

Now that you know the purpose of the spreadsheet, you can clone it and try it by yourself (make sure not to share it accidentally on the internet).

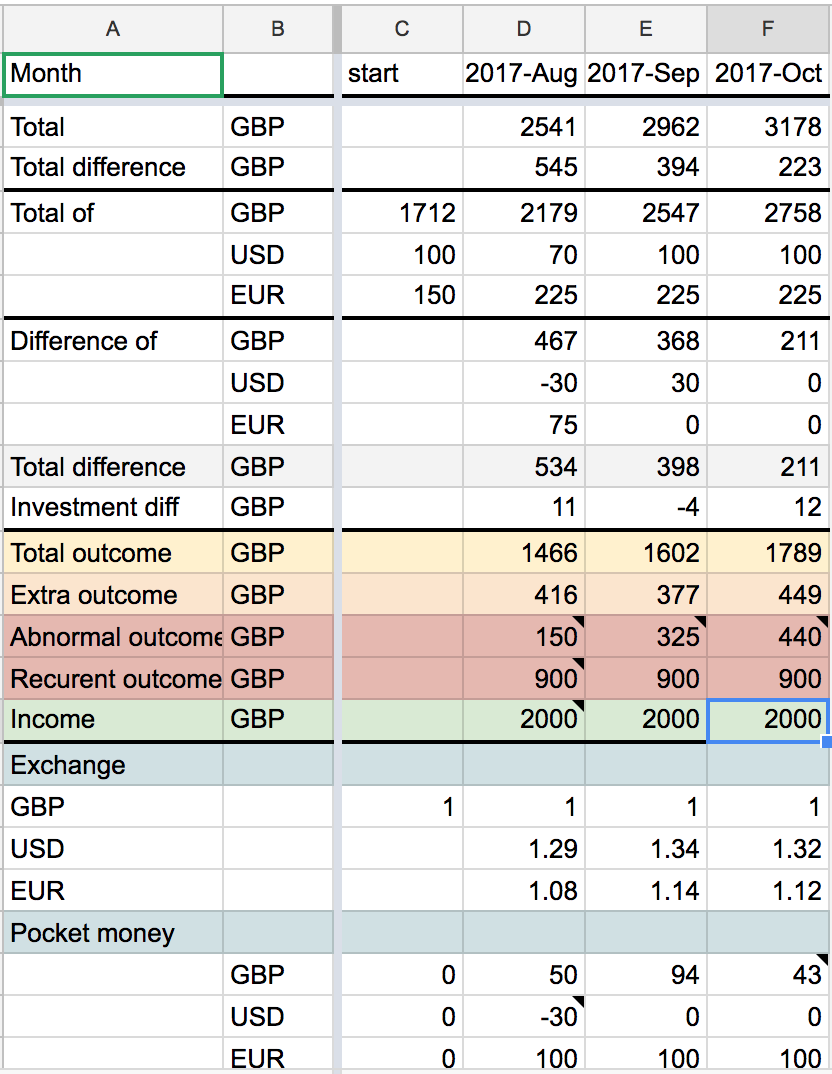

Everything from top to Extra Outcome inclusive is automatically calculated. Most important things in there are:

- Total amount of money you have

- Total difference - did it go up or down

- Total outcome - how much did you spend this month

- Extra outcome - how much money you spent on random things (everything that didn’t fall into recurrent and abnormal outcome)

Monthly routine

Every month I go through the following process:

- Create one column on the right

- Extend the selection from previous column to the newly created one. That will copy all the formulas and will update them correctly

- Update month

- Update exchange rates

- Write down your Income (salary, found money on the street), Recurrent outcome (bills, rent) and Abnormal outcome (bought a new TV)

- Write down balances of all your accounts

Now you can easily see where your finances are each month.